Boiler and machinery insurance sounds like an analog policy in a digital age, but it is an important coverage consideration for virtually every modern business.

The insurance has its genesis in the 19th century when factories relied on coal-fired boilers to generate steam and power machinery. In these early days the loss frequency was exceptionally high, and as insurers came into the market, they insisted on new risk management practices and improved ongoing risk performance.

Risk assessment and management remains central to the boiler and machinery insurance proposition today. The maxim that prevention is better than cure still holds true, given losses can run to billions of dollars and impact businesses for many months.

Coverage

Boiler and machinery insurance is designed to cover the cost of repairing or replacing machinery and equipment as a result of sudden and accidental breakdown, as well as contingent losses including physical damage, business interruption and increased cost of working.

Standard property insurance will cover the repair and replacement of equipment lost as a result of insured perils such as fire and flood, but will not respond to equipment breakdown and/or failure. It is this gap that boiler and machinery policies fill.

Boiler and machinery in today's terminology

It is not only manufacturing and heavy industry that rely on commercial equipment and machinery. Whether working in finance, pharmaceuticals, hospitality or professional services, businesses have a growing dependency on their equipment.

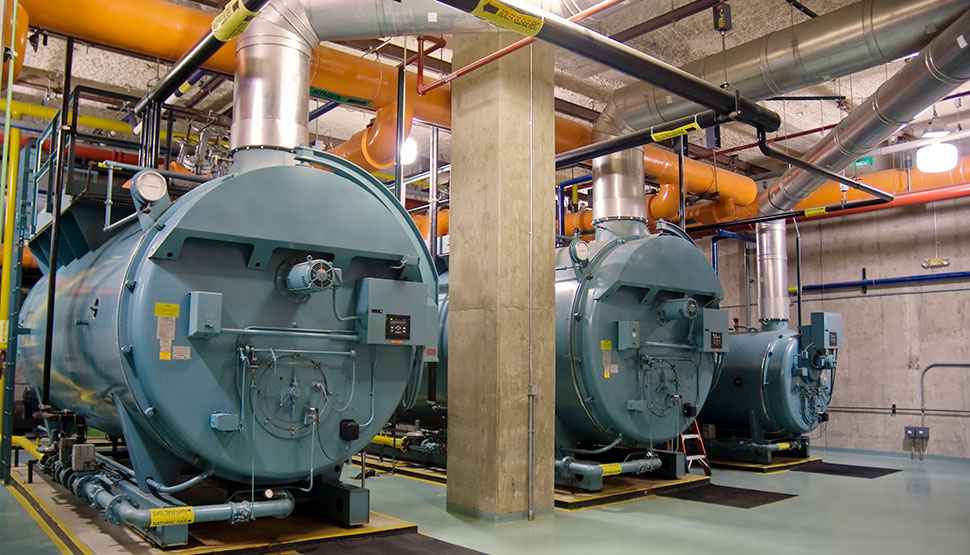

Boiler and machinery insurance has evolved to reflect this and now covers virtually any piece of mechanical or electrical equipment. Items range from industrial turbines and furnaces to photocopiers and air conditioning systems. They generally fall into the following categories:

- Pressure vessels

- Refrigeration systems

- Pumps and compressors

- Heating and air conditioning systems

- Turbines

- Electronic data processing (EDP) systems

- Engines that utilize electrical or mechanical energy, or are under steam pressure

There are few businesses that do not run equipment that falls under these headings, but how many insure against the damage it may wreak in the event of failure and/or breakdown?

Risk assessment and management

In addition to the financial protection offered by boiler and machinery insurance, the coverage enables companies to build resilience into their operations through better understanding and management of their exposures.

It is incredibly difficult to oversee and maintain a hugely diverse range of equipment across a national or international portfolio of locations. But this is exactly the challenge facing today's big businesses.

Working with a specialist insurer conducting on-site risk surveys, companies can get a detailed understanding of their vulnerabilities and an accurate assessment of potential associated losses.

Over a third of all electrical system failures can be traced to human error, whether as a result of carelessness, training failures, inadequate maintenance, or delayed service. Managing and surveying operator performance will identify issues such as:

- Misuse of equipment

- Allowing dust or dirt to gather on electrical equipment

- Deliberately overriding safety devices

- Inappropriate shutdown and/or startup procedures

Assessing the potential loss from identified issues enables companies to prioritize remedial action, implement consistent standards, target training and improve their risk profile.

But effective risk management is about more than improving employee behavior. Equipment failure can bring businesses to a standstill and so assessing and predicting likely failures can prevent this from happening and create significant efficiencies in existing maintenance programs.

Detailed inspections generate the data to make informed decisions on expediting or delaying scheduled services and maintenance. They enable companies to design a program that prioritizes required action rather than sticking blindly to the standard recommended timeframes.

This level of insight also enables firms to forward plan maintenance programs around seasonal dips or production cycles. Where machinery needs to be replaced, identifying its remaining lifespan early allows companies to factor in the long lead times that often come with complex equipment and minimize disruption when they are decommissioned.

Looking beyond the benefits of an expertly informed and more efficient maintenance program, companies must comply with the litany of regulatory and legislative obligations that relate to commercial equipment and machinery.

Specialist insurers can identify all the applicable inspection requirements and ensure policyholders take the mandatory steps to achieve compliance and keep on the right side of the law.

Boiler and machinery insurance and associated risk management empowers companies to identify, quantify and address vulnerabilities before they turn into losses. It enables businesses to take control of their equipment exposures and to become more resilient by managing them proactively.

In today's commercial environment, companies in all commercial sectors, not just heavy industry or manufacturing, could benefit from this expert insight and support.

Find out more about FM Global's boiler and machinery (B&M) coverage

Related content:

Shut Down the Breakdown: An inside look at high-hazard risk management

Boiler and Machinery Expertise: Stora Enso and FM Global

Cream of the Crop: How one fertilizer manufacturer's top-notch boiler and machinery program helps put food on your table